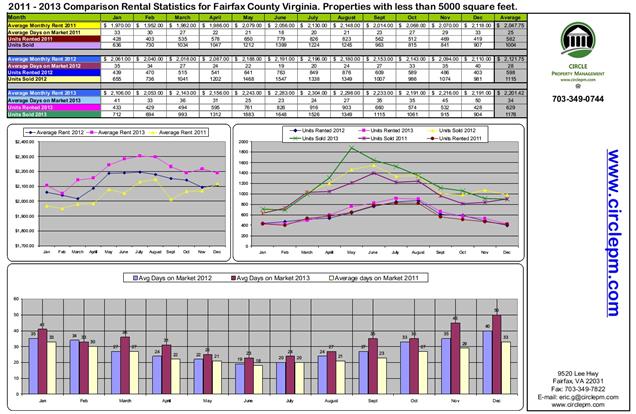

Reflecting On The 2013 Rental Market?

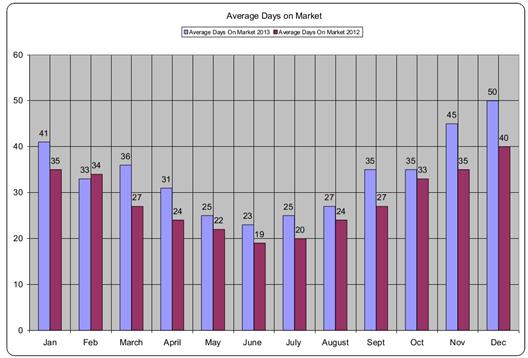

We closed out 2013 with allot of new highs, including days on market, (the time a listing is ACTIVE in the MLS system.

The time it took to rent in December hit 50 days. We prefer to see this bellow 40.

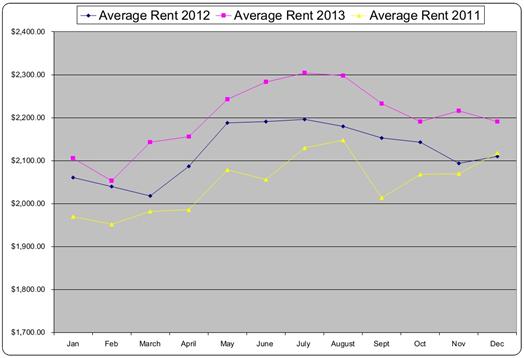

With the record highs in average rented prices, we feel a bit uncomfortable but optimistic for 2014. We hit allot of historical highs in 2013 and the average rent per month for all properties hit a High in July, topping $2300.00

The rental market seems stable for now but the larger question is how will 2014 play out? We have seen a steady increase in rents since 2011 with the average rent for 2011 coming in at $2,047 rising to $2,121 in 2012, closing out 2013 with the average rent at $2,201 a 7% rise in rents since 2011. The highest recorded rental average was in July 2013 topping out the charts at $2,304.

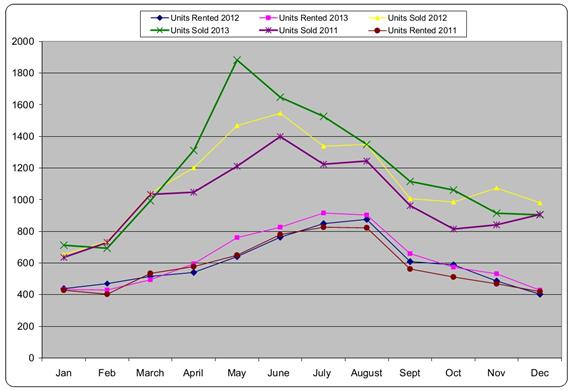

Home sales were strong in 2013 (Avg.1176 per Mo.) beating out 2011 (Avg. 1004 per Mo.) and 2012 (Avg. 1115 per Mo.). Despite the demand for home sales we have not seen a decline in rentals and actually saw an improved market year over year. With mortgage rates on the rise and affordability declining, we anticipate a need for affordable rentals and rentals as a whole. Despite our concerns with a potential topping out of average rents we do feel 2014 will be a good year.

We have added a new metric to our reporting which might give some additional insight to the ACTIVE supply of rental listings. Beginning in January we will be tracking Active listings giving us insight into the supply of rental properties, comparing rented properties to active establishes the number of months it will take to rent the current supply.

As an example: On January 2nd Circle Property Management reported 1,142 Active rentals and 428 units rented in December which is a 2.6 months supply.

Download The Full Year End Chart: Circle Property Management Year end report

Demographic Trend (Maybe?)

We are encouraged by several demographic indicators noticed recently communicating with potential clients. We might see some reverse migration of millennia's moving to the suburbs from the city and starting families. This cohort has been living in DC in their 20's now beginning to think about family formation and settling down.

Circle Property Management is performing well and meeting client expectations. Our Landlords have been pleased with the performance of their properties and we look forward to another good year. We completed our audit and we do not expect any price increases for 2014.

BTW someone asked where we obtained these charts? We make these in-house using excel. The data is raw from the MLS system and we have asked for charting of rentals like sales reports but the MLS system has no plans to provide them.

About The Author

Eric Guggenheimer - SFR, ARM ® » Principal Broker, Certified Property Manager, IREM, ARM, NARPM, NVAR, NAR, VAR

Eric Guggenheimer - SFR, ARM ® » Principal Broker, Certified Property Manager, IREM, ARM, NARPM, NVAR, NAR, VAR